Let's start

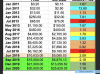

Let's start. We have two charts: $BTCUSD on the left side, $BTCUSD on the right side. You might or might not know it, $BTC really likes to draw the

same patterns or combinations of patterns on both, small and big time frames. On the left side there is a 2017 bull-run, while the right side shows nowadays.

First of all, let's consider

colored patterns. We have three correctional phases, then a down-trend from the

ATH , then a smaller triangle with the flat bottom

(support) and the continuation of the

dump. Then, the price has formed a triangle with the flat resistance

( bullish pattern ). We could finish there,

BUT there is one difference, which is a crossroads of the continuation of these "fractals".

I hope you've

already noticed that on the right side there is forming a

bullish pattern -

Double Top. This pattern indicates the next high at the $15000 level, the local

ATH is located at the same $15000 level. On the left side we have the first

ATH at the $19000 level, but the

second local ATH was located at the $15000.

I can explain this difference by the fact that in

December 2017 the price was pumping insanely, everyone expected

ATH at $15000 or $17000, but not at $19000. Thus,

previous ATH was formed “by accident”, unlike the current

ATH ($15000) which is adequate.

No matter how strange this sounds, but I don't mean that the price should

simply go down after the formation of a

Double Top . If we take a look at the chart more

globally, we would notice that the price is forming another large Triangle with the flat resistance and ascending bottom, which means that the price will

break through the $15000 level and will form the same

Double Top in the $19000 zone. This pattern, in its turn, will form another triangle with flat resistance on the

weekly chart and then the charts will be completely identical